Many landlords wish to transfer property to their children in later life or sometimes to simply assist their children on to the property ladder. Gifting a property to family members should be undertaken only after careful consideration of any of the tax implications, otherwise you could end up with an unexpected tax charge. If you gift a property to family members, you may have to pay Capital Gains Tax (CGT) as you are deemed to be disposing of an asset. The fact that you may be gifting a property for no money consideration is irrelevant. HMRC will regard the transfer to be at full market value. This includes selling a property at a price below its market value.

The rules depend on who you make the gift to.

Gift to a spouse or civil partner

A gift to a spouse/civil partner is a ‘no gain no loss’ transaction. You do not pay any CGT when you make a gift to your husband/wife or civil partner as long as you are living together.

However, the recipient spouse of the gift will take on the original purchase cost of the property. If the recipient spouse or civil partner later disposes of the property, they are taxed as having purchased the asset for the original cost and not at the market value on the date they received the asset.

Example – sale of a property received as a gift

Rachel bought a property in 2000 for £50,000 and gifted it to her husband, Jeff, in June 2008 when the property was worth £100,000. Jeff later sold the property for £140,000, in July 2024.

Jeff’s gain on the property before any other deductions will be £140,000 less the original cost of £50,000, which is a gain of £90,000. It will not be £40,000 (£140,000 less £100,000).

Gifts made during separation or divorce

If you were separated from your spouse or civil partner prior to 5 April 2023, you could only get ‘no gain no loss’ treatment when transferring an asset up to the end of the tax year in which you separated. This could be problematic if say a couple separated in February as it would only leave one month for any transfer to take place.

The rules were therefore changed to recognise that a separation in many cases could take a while. For separations and transfers on or after 6 April 2023, separating spouses or civil partners are given up to three years after the end of the tax year in which they cease to live together to make no gain no loss transfers.

Example – gift of a property as part of a formal divorce agreement

Andy and Sarah are married and jointly own a rental property. They separated permanently in December 2023. In July 2024, they agreed that Sarah will receive Andy’s half share of the rental property as part of their separation.

The transfer will be a ‘no gain no loss’ transfer as it will take place within three years of the end of the tax year of separation.

Sarah will receive the half share of the property at Andy’s original purchase cost of the property for CGT purposes and therefore might suffer a CGT charge on the sale of the property in the future.

Gifts to other family members

When you make a gift of a property to a family member or other person you are 'connected' with, other than your spouse or civil partner, the gain or loss will be based on the market value at the time of the gift.

This also applies if you sell an asset to a family member for less than its market value. In this case the actual proceeds you receive are irrelevant in calculating the gain or loss as once again it is the actual market value of the property that will be used to calculate any CGT.

If you make a capital gain, you will have to pay CGT if, after claiming any reliefs, the gain is more than the CGT Annual Exempt Amount.

If there is a loss on a gift you make to a connected person, the loss can only be deducted from gains you make on gifts or other disposals to the same person. These are known as ‘clogged’ losses.

You may be able to claim Gift Hold-Over Relief if the property being gifted is a business asset which means that no CGT is payable on the gift. This only applies to properties that meet the criteria to be a Furnished Holiday Let. However, as of April 2025, the Furnished Holiday Let treatment of properties is abolished.

Connected person

You are connected to a relative, and they are connected to you, in any of the following cases:

- you are their direct descendant (your parents, grandparents, etc.)

- they are your direct descendant (your children, grandchildren, etc.)

- they are your brother or sister

- they are the spouse or civil partner of any of the above relatives

- they are connected to your spouse or civil partner

The term ‘relative’ does not cover all family relationships. In particular, it does not include nephews, nieces, uncles, aunts and cousins.

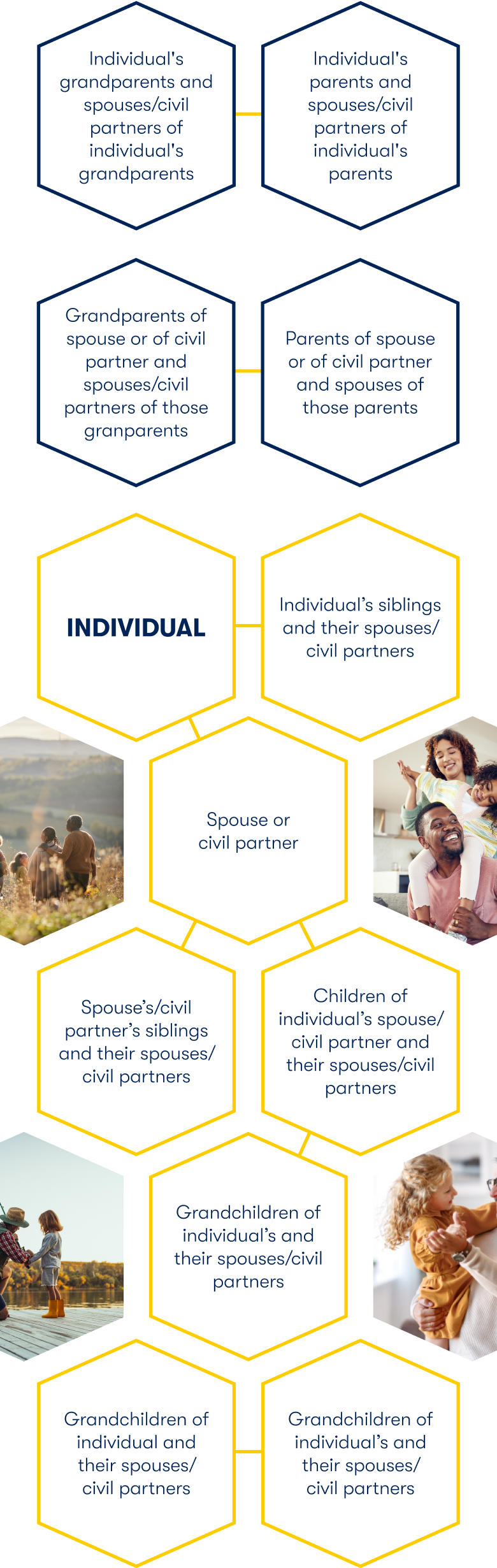

The following diagram illustrates the provisions of the term ‘connected persons’. All of the people in the diagram are connected with the individual. They are not all connected with each other.

A connected person can also include either of the following:

- a company you control

- certain trustees