Higher rate taxpayers purchasing a property in their personal name

If a higher rate taxpayer purchases a property in their personal name, they will be exposed to 40% Income Tax on their rental profits and subject to restriction of tax relief on their mortgage interest payments.

Due to these disadvantages, individuals are forced to consider alternative ownership methods such as a limited company. However, there can be substantial one-off costs involved with transferring a property to a limited company, namely Capital Gains Tax and Stamp Duty Land Tax.

Individuals can avoid this bad set up by purchasing the property in a limited company at the outset. The benefit for higher rate taxpayers in doing this is that the tax rate on the rental profits can be reduced to 19% and they would be entitled to full tax relief on their mortgage interest payments.

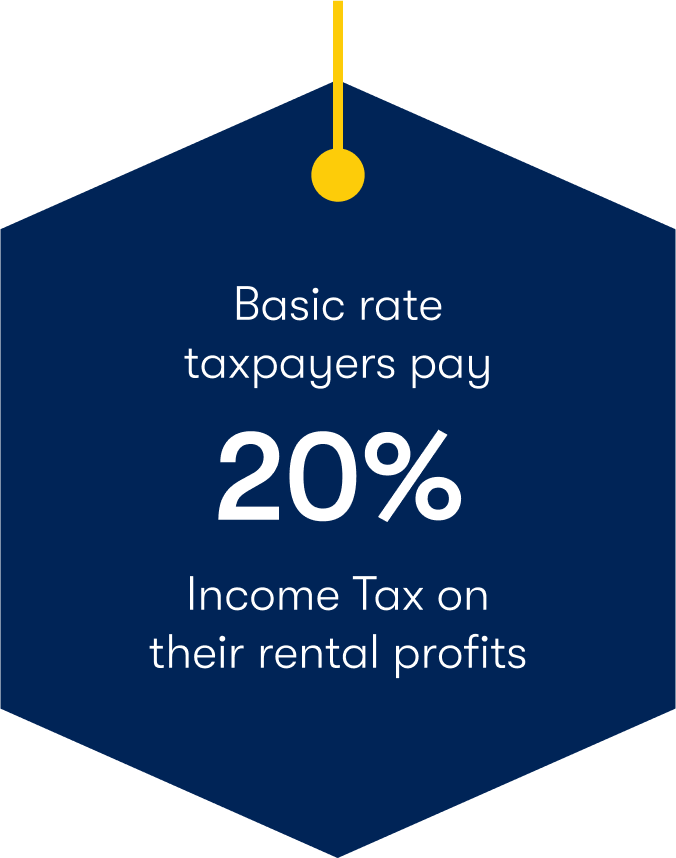

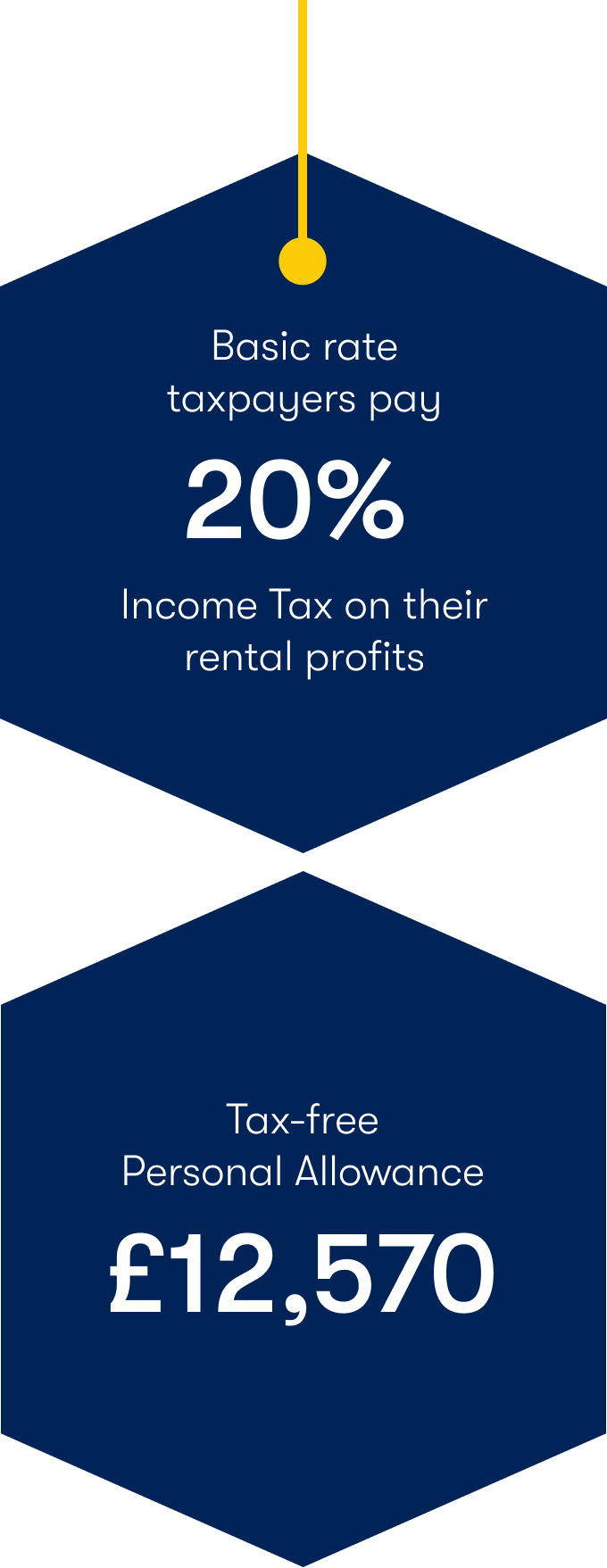

Basic rate taxpayers purchasing a property in a limited company

Basic rate taxpayers pay 20% Income Tax on their rental profits and can claim full tax relief on their mortgage interest payments. Further, if the profit from the property is below the tax-free Personal Allowance of £12,570 and this is not already being utilised by other sources of income, the taxpayer will be able to receive the profits from the property tax-free.

As mortgage interest rates are higher in a limited company, basic rate taxpayers can be worse off by owning properties in a limited company as the tax rate is almost the same and they would be taxed again if they ever wanted to withdraw any of the rental income from the limited company.

To avoid this bad set up, basic rate taxpayers may be better off by owning properties in their personal name to take advantage of the lower mortgage interest rates and they would be able to access the rental income without any further tax implications.

Individuals purchasing a property in their personal name whilst owning other assets

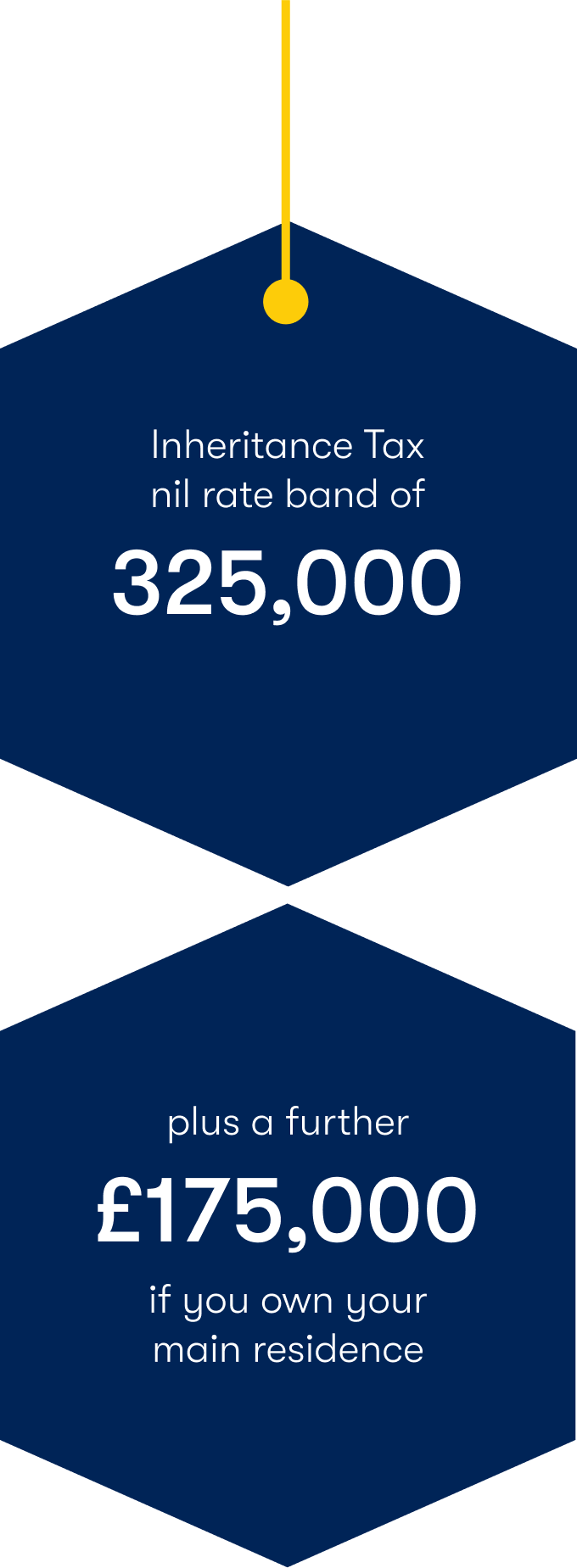

Individuals who plan to purchase rental properties to hold for the long term and want their children to inherit them when they pass away must carefully consider Inheritance Tax.

There is an Inheritance Tax nil rate band of £325,000 plus a further £175,000 if you own your main residence.

This means that if an individual owns another asset which is already worth more than the Inheritance Tax nil rate bands, such as a main residence, they would be exposing their equity in their rental properties to an Inheritance Tax charge at the rate of 40% when they pass away.

This bad set up can be avoided by purchasing properties in a limited company. If a limited company is structured correctly, individuals can incorporate passing growth in property value to children and out of their Inheritance Tax estate to protect their property wealth for their children and bloodline.

Purchasing a property in a trading limited company

Individuals who already have a trading limited company, for example IT consultants, look to use their company funds to purchase investment properties in their trading company to take advantage of the benefits from owning a property in a limited company. However, by doing this, the director may jeopardise their privilege to many benefits of operating a trading company.

The risks of purchasing investment properties in a trading limited company include losing the entitlement to claim certain Capital Gains Tax and Inheritance Tax reliefs that are available to the trading company. There is also the potential risk of the company losing its properties in the event of the trading limited company going bankrupt.

To overcome this risk, trading company directors should purchase property in a separate investment limited company so that their properties are protected and they do not taint their eligibility to claim any Capital Gains Tax and Inheritance Tax reliefs.

Setting up a limited company with only one director

If a landlord incorporates a limited company with themselves as the sole director, if they were to pass away then the limited company will be unable to operate as usual until the time that the company is able to appoint a new director.

This process may take a significant amount of time, potentially forcing the limited company to abandon any property purchases or mortgage applications that were in progress at the time of the director’s passing.

Limited company landlords can avoid this bad set up by setting up the company with another director, such as a partner, as this would mean that there is no such issue if one of the directors were to pass away or be incapacitated for any reason.