The nation finds itself at a critical moment, with signs of change ushered in by a newly elected government. This moment brims with promise, yet it also calls for swift action to resolve the policy uncertainties that loom over the private rented sector.

With change afoot, it is great to see some positive signs coming out of the industry. New research from Pegasus Insight[i] shows that a significant 82% of landlords view current tenant demand in their rental areas as ‘strong’, with 40% describing it as ‘very strong’. In addition, the rate of arrears continues to decline, suggesting positive signs that the market is moving forward.

All this points to opportunities for landlords who want to provide their tenants with not just a property but a home. But where are the growth opportunities for these landlords?

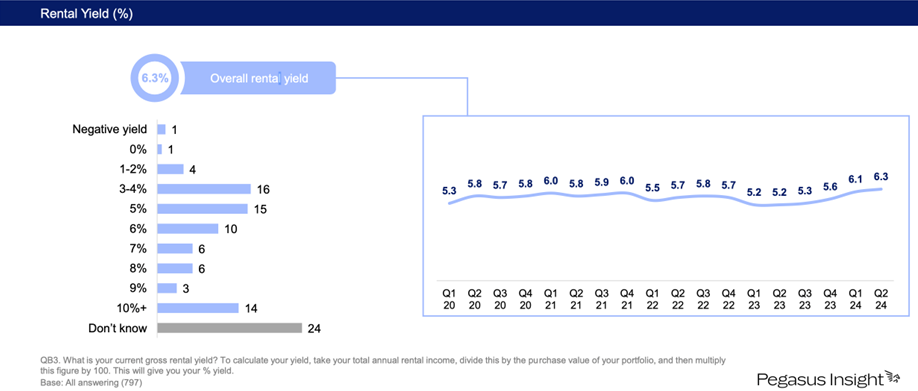

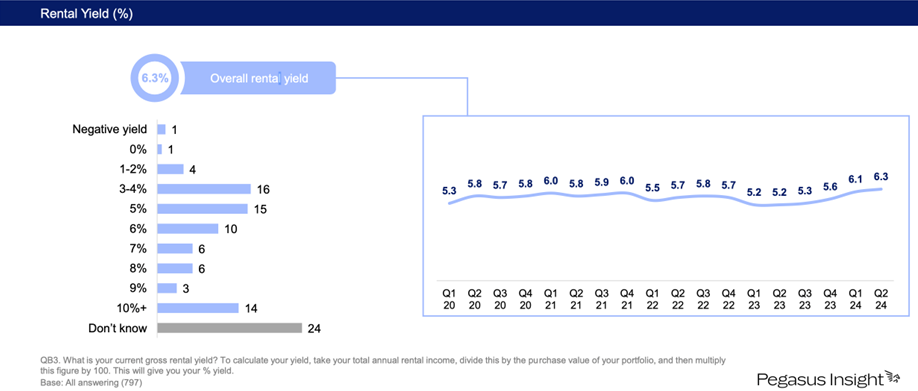

Encouragingly, the Pegasus data shows that average achieved yields have surged to a 10-year high of 6.3%. Particularly, owners of House in Multiple Occupation, and landlords who rent properties to students, are seeing above-average yields - with returns of 7.2% and 7% respectively. This profitability comes from the ability to maximise earnings by accommodating multiple people under one roof, each contributing to the overall rental income.

For those looking to expand their buy-to-let portfolios, targeting these high-performing sectors presents a golden opportunity that not only reaps robust returns but also taps into markets that are both resilient and in high continuous demand.

Additionally, as winter approaches and concerns about rising energy bills grow, landlords have an opportunity to get ahead of the competition and enhance their properties’ energy efficiency. These upgrades are not just about cutting costs — though they will certainly do that — they are about creating homes that stand out in a competitive market at a time when tenant demand for sustainable homes is increasing.

Energy-saving measures, such as installing double-glazed windows, upgrading boilers or adding loft insulation are great places to start and, in most cases, do not require a huge lift. We know from our own research - Landlord Leaders[ii] - that two-thirds (66%) of landlords have either already invested or are planning to invest in anticipation of legislative reform.

So, what’s next? Well without a crystal ball, the future is difficult to predict. But with a new government in place, there is a collective hope that we will see a significant step change to more long-term thinking and focused leadership that prioritises the health of the private rented sector and assisting those landlords in it. Consistency at the top would be nothing short of a breath of fresh air, bringing the kind of sustained attention and clear direction that could truly drive meaningful progress.

As an industry, we must step up collectively alongside the new government as advocates to champion the private rented sector. And while the shift to the professionalisation of the sector is not an overnight quick fix, we need to see a holistic, cross-industry approach that supports the lived experiences of tenants and the landlords housing them.

[i] Pegasus Insight - Landlord Trends Research Report - Q2 2024 (July)

[ii] Landlord Leaders Survey - conducted by Opinium Research between 18 December 2023 and 2 January 2024

By :

By :

Comments

Complete the form on this page to submit your comment, and register your interest in the Landlord Leaders Community.